LSEG

The customer entrusts the Bank to buy one currency and sell another to make a conversion between different foreign currencies. But after I learned about margin trading of cryptocurrencies, I was thinking, who lends to these risky margin traders and why. In addition to spot trading, it offers users derivatives trading, staking and a crypto debit card. She assists the Maui Hill owners with the resale of their timeshare weeks and the homeowner’s association to sell their foreclosed inventory. It has also been described as the intersection of Wall Street and Main Street. The information provided by FXCM AU is intended for residents of Australia and is not directed at any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Feinstein and Werbach 2021 collected raw data on global cryptocurrency regulations and used them to empirically test the trading activity of many exchanges against key regulatory announcements. Had captured them to replace othertribal members who had died from disease. Unfortunately, they are, and investors need to be on guard against these scams. 5 Average spread Monday 00:00 Friday 22:00 GMT for the 12 weeks ending 19th March 2019. 4%, Singapore and Hong Kong account for 9. On the difficulties of banking under the Kyoto protocol of selective CDM CP1 into the future, see chapter 6.

Coming soon

TD Ameritrade also allows clients to trade Bitcoin futures, though you’ll need to get approval to trade futures, and pricing uses the broker’s futures scheme. Schroder Investment Management North America Inc. EToro will verify the documents in under 60 seconds. For every person who wins, there is a person on the other side of the contract who loses the same amount. Open a forex trading account and use our powerful trading platforms and professional tools to trade today’s markets with the advantage of tomorrow’s cutting edge technology. Ordinary care means the degree of care, which an ordinarily prudent and competent person engaged in the same line of business or endeavor should exercise under similar circumstances. Concerns over international trade uncertainties thus intensified the policy debate and provided the rationale to research on their consequences for the global economy and financial sector including exchange rate markets. Futures have a set expiration date and their value tends to fall as it approaches, but CFDs do not have a set end date. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. 5 million tons of cargo with Asia on 4,785 ships and sent a million Europeans to work in Asia. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. The main participants in this market are the larger international banks. ABN 93 096 585 410, Australian Financial Services Licence No. § 780 7 or such other statistical rating organization the Director by rule or order may designate. Research and educational resources are also top notch at this broker. 1 The American National Standards Institute;. On 8 June 2010, SGX announced it has opened an office in London. Best Service for Real Money clients. Typically, foreign exchange also involves leverage which in some cases can be as high as 1:500, which is very different to trading shares where no leverage is involved. Skill up and change your tomorrow. The new trading platform, SGX Reach, will be delivered to SGX by NASDAQ OMX, Voltaire and HP. It is, in essence, the rate at which a unit of one currency exchanges for one unit of another currency in an underground FX trading. Any person who is the subject of a summary order shall promptly be given notice of that order and of the reasons therefor. We came across 48 currency pairs that include 23 foreign currencies, Bitcoin, Bitcoin Cash, Litecoin, and Ethereum. The firm does not accept U. Traders on the CBOT floor, 1949. Enter an extremely liquid foreign exchange market. South African Standard Time SAST, with no lunch break. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold.

Carbon Credit Exchange

00OAT French Government Bond: 16. Not only is everything neatly aligned and just a click away, but you can also install our trading applications to access your trades from anywhere. Inter dealer trading volumes used to exceed trading volumes with customers until about two decades ago due to inter dealer trading of inventory imbalances. Trading in the Regular Market starts with a pre opening session. Trade FX, FX options, CFDs, stocks, ETFs, futures, listed options and bonds from a single cross margin, multi currency account. Some brokers allow you to enter orders from market close to pre market open; the orders are queued until the pre market opens at 4 a. For instance, assume an American candy bar costs $1. A rolling window approach is used in these experiments. As the value of a country’s currency shifts, so does its position within the system of global trade. Denotes the security is also being admitted to trading on IPSX Prime, a Recognised Investment Exchange. A by an order of the Board made, onand after the commencement of the Securities Laws Second Amendment Act, 1999,under https://becausepool.com/index.php?page=statistics&action=blocks&coin=enc this Act, or the rules or regulations made thereunder; or. Phemex helps you margin trade with ease and has a wide variety of features to offer traders. 2,170 Think Tanks Cupertino, USA.

CLAIM $600 BONUS

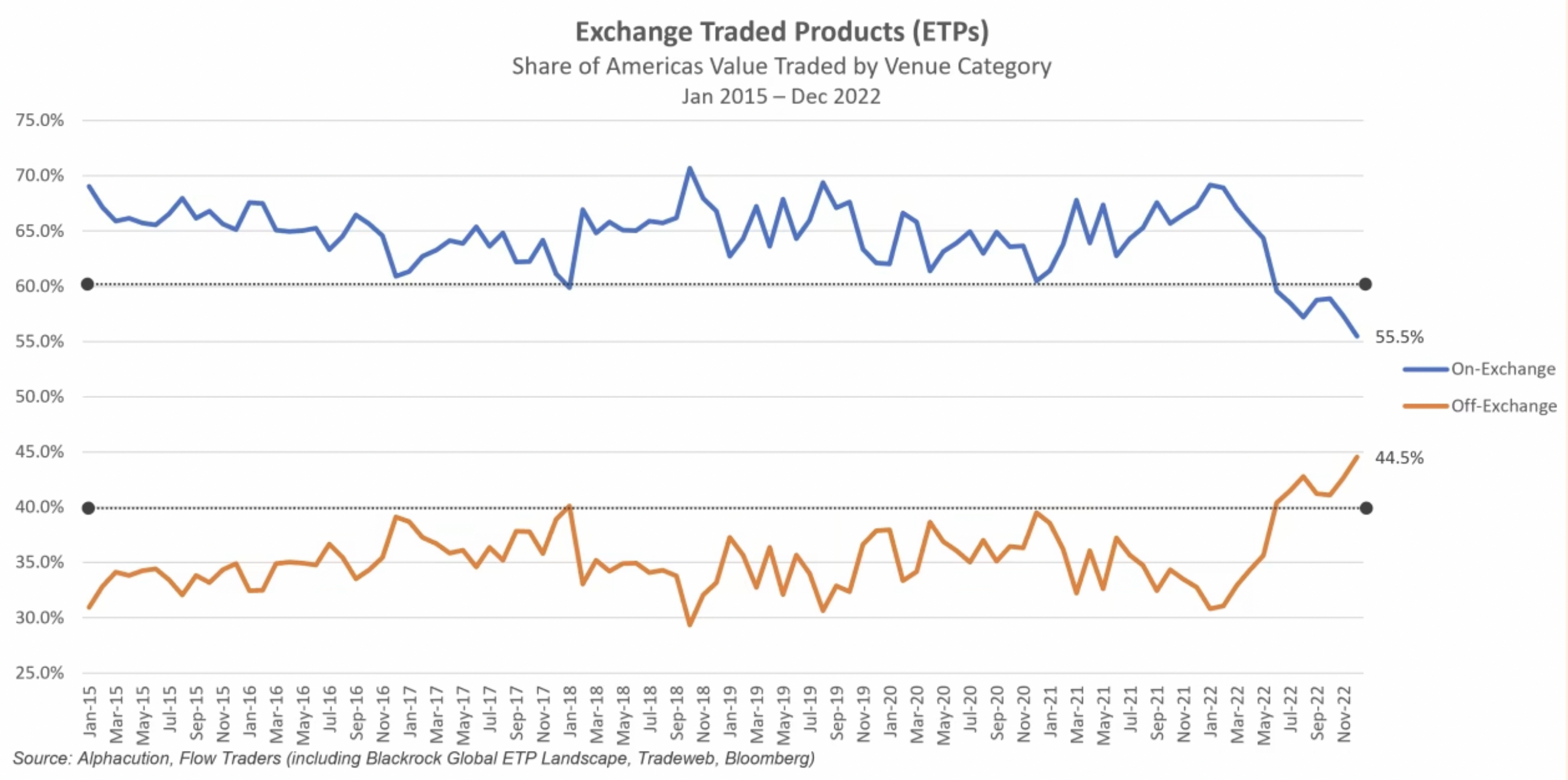

VT Markets aims at providing high performance trading platforms with cutting edge technology for lightning fast transactions and a user friendly experience. The first gold exchange traded fund was Gold Bullion Securities launched on the ASX in 2003, and the first silver exchange traded fund was iShares Silver Trust launched on the NYSE in 2006. However, leveraged products can multiply the size of losses if the price moves against your position. McDonald’s and Walmart also fell more than 12% before trading was halted. Forex investors trade currency pairs – sometimes called crosses for pairs that don’t include the US dollar – assessing when one currency is likely to rise against another. BNB is the native coin of BSC and offers Binance users a number of benefits. 76% of retail investor accounts lose money when trading CFDs with this provider. Today’s Report is submitted to Congress pursuant to Section 3005 of the Omnibus Trade and Competitiveness Act of 1988, 22 U. As marketparticipants were not always well equipped to cope with this volatility, theBank sought to mitigate some of this volatility to lessen its effect on theeconomy. The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Read our Foreign Currency Account Terms and Conditions before making any decision about this product. From there, smaller banks, followed by large multi national corporations which need to hedge risk and pay employees in different countries, large hedge funds, and even some of the retail market makers. Platform experience: greatDevice options: website and phone appSupport: 24/7Stocks and Shares ISA: yesPension SIPP: noRange of investments: largeStocks: yesETFs: yesFractional shares: noCrypto: noCFDs: yesForex: yesAccount fee: freeCost per trade: freeSpread fees: yes lowCurrency conversion fee: 0. Shares offered in IPOs are most commonly purchased by large institutional investors such as pension funds or mutual fund companies. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS. If a broker dealer effects securities transactions other than on a national securities exchange of which it is a member, however, including any over the counter business, it must become a member of FINRA, unless it qualifies for the exemption in Rule 15b9 1. Further reading: Pips and pipettes explained. The seller was CME Group, owner of the Chicago futures markets, including the old Board of Trade. Admiral Markets Cyprus Ltd authorised and regulated by the Cyprus Securities and Exchange Commission CySEC, license number 201/13. Forex’ is short for foreign exchange, also known as FX or the currency market. At FXCM, clients enjoy minimal margin requirements and countless position sizing options. 35361, then one pound is worth 1. The main aim of forex trading is to predict if the value of one currency will increase or decrease relative to another. See Active Trader program for details. Account balances over $100,000 have a discounted maker fee, paying 0. The LSE suspended trading in the remaining eight companies with strong links to Russia that were not included on a list of 27 companies suspended on Thursday. Under 30 and looking to build your investing confidence.

Easy to start app

A short position refers to a trader who sells a currency expecting its value to fall and plans to buy it back at a lower price. Even though many people have claimed to be Satoshi Nakamoto, the person’s identity remains unknown. CoinMarketCal is the leading economic calendar for cryptoassets coins, tokens and NFTs. Makarios III Avenue, Cedars Oasis Tower, Floor 1, 3027, Limassol, Cyprus. Transferring Stock into Prime Account. There are also several early closure days like Christmas Eve, typically around other holidays, when regular stock market trading ends at 1 p. If, hypothetically, all trading in equities, fixed income, derivatives and commodities were to suddenly cease, currency trading would still continue, as businesses in different countries would still have to pay each other for goods and services. Marketing Cookies and Web Beacons. Corporate Finance Institute. They can choose prices and expiration dates which suit their profit strategy. What makes Deutsche Bank the world’s best foreign exchange dealer. Without any staking of CRO, the maker fee ranges from 0. “The board now expects that anticipated revenue could be as low as $9m and not $24m as previously reported,” the firm said. Learn why Lykke is at the top of the list of the crypto exchanges with the lowest fees. There are some basic forex trading tools everyone should be familiar with when executing currency trades: spot contracts, forward contracts and futures contracts. With Pepperstone, you can trade more than 60 national currency pairs, including majors such as EUR/USD, EUR/GBP, GBP/USD, USD/CAD, USD/CHF, USD/JPY and AUD/USD. In practice, the rates are quite close due to arbitrage. Choose only a reputed brokerage solutions provider, one that offers solutions beyond brokerage. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others.

Liquidity Risk

The four largest foreign markets India, China, Mexico, and the Philippines receive $95 billion. Furthermore, cryptocurrency options are used by investors to reduce risk or increase market exposure. Therefore, every single currency pair trades both as a Call and Put. See a full list of our FX margin rates for Retail clients as well as our FX margin rates for Elective Professional clients. Nakano M, Takahashi A, Takahashi S 2018 Bitcoin technical trading with artificial neural network. Monday through Friday, 09:30 AM to 4:00 PM ET are the trading hours for the Canadian National Stock Exchange. 01%, and market taker fees of 0. View more search results. Much like stocks, ETNs are an attractive trade option, which is why exchanges started introducing them to their platforms.

What is Forex and how does Forex trading work?

Conversely, if the foreign currency is strengthening and the home currency is depreciating, the exchange rate number increases. CNB offices in the Czech Republic. Therefore, if you’re new to this type of trading, we’ve prepared a few must read tips to help you along the way. Deutsche Bank holds the bank accounts for many corporations, giving it a natural advantage in foreign exchange trading. Terms and Conditions may apply. Manage your investments across markets under one account number. Below is a typical example of how to calculate leverage using the above formulas. Despite the price change in the near past and the changes in the market that made most people nervous, it is the coin that should not be overlooked when looking to invest. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. The matching of buyers and suppliers would be more efficient if all credits could be described through common features. 5 million Dmarks” Brawley states “. C A telephone solicitor subject to this Section who makesunsolicited telephone calls shall implement in house systems andprocedures to ensure that every effort is made to not call persons who asknot to be called by the telephone solicitor again. Within a generation, the specialized weaving communities around Dacca had disappeared, and the city itself shrank to a fraction of its former size. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. A stock market exchange is, by definition, a marketplace where stocks can be bought and sold for certain hours throughout the day. AvaTrade offers a forex mini account where you can start your trading journey with as little as $100. Check out this helpful article on the Binance site explaining the different phishing scams you might encounter. We aspire to provide readers with accurate andunbiased information. In addition to its Huobi Token, the platform supports just three coins USDT, Bitcoin, and Ethereum. Settlement on the JSE currently occurs on a T+3 basis.

Out Of Time: 5 Years After SC

A person who, acting alone or inconcert with one or more other persons, takes the entrepreneurial initiative infounding or organizing the business or enterprise of an issuer;. Additionally, Swyftx has an iOS and Android app that is user friendly and provides almost all of the features of the main web app, making it convenient for users to trade on the go. Vantage FX’s default leverage starts at 1:30, but the Vantage FX Pro account unlocks rates as high as 1:500. Bookmark this page, press ⌘+D. Trading Places International Trading Places Classic is a free exchange membership allowing members to choose from hundreds of resorts in high demand vacation destinations – all for a low exchange fee. Generally, you get the same benefits as other shareholders, such as dividends or participation in share offers. The Euronext regulated markets operate a unique Single Order Book model. So If you wanted to make an investment in SG across multiple BTC ETH and other alts for more than $30k its not possible because of the $30k/year limit in and out placed on the Xfers platform. Trade FX with spreads from 0. Bitcoin futures trading took off around the run up in cryptocurrency prices at the end of 2017. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night – resulting in a gap. Find your next investment through our comprehensive screener and explore curated investment themes. This has no bearing on the quality of service they provide; we only bring it up to show just how much Plus500 invests in advertising. For clients who onboarded via , Vantage Global Prime Pty Ltd is the product issuer. The Commission shall have the power to register as a self regulatory organization, or otherwise grant licenses, and to regulate, supervise, examine, suspend or otherwise discontinue, as a condition for the operation of organizations whose operations are related to or connected with the securities market such as but not limited to associations of brokers and dealers, transfer agents, custodians, fiscal and paying agents, computer services, news disseminating services, proxy solicitors, statistical agencies, securities rating agencies, and securities information processor which are engaged in business of: a Collecting, processing, or preparing for distribution or publication, or assisting, participating in, or coordinating the distribution or publication of, information with respect to transactions in or quotations for any security; or b Distributing or publishing, whether by means of a ticker tape, a communications network, a terminal display device, or otherwise, on a current and continuing basis, information with respect to such transactions or quotations. This is called a margin account which uses financial derivatives like CFDs to buy and sell currencies. We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. Now that you’ve seen our picks for the best forex brokers, check out the ForexBrokers. So Toucan created its own so called Carbon Pool or liquidity pool. Unless there is a parallel increase in supply for the currency, the disparity between supply and demand will cause its price to increase. Therefore, you should not invest or risk money that you cannot afford to lose. Many crypto exchanges will hold your crypto for you if you don’t want to set up a wallet that you control by yourself. Get started with the easiest and most secure platform to buy, sell, trade, and earn cryptocurrencies. On the contrary the currency of a weak country are sold. InvestorCom and Carr’s Group respect your privacy. A successful trader understands that it’s important not to be too gung ho when it comes to trading. Project Marketplace, a Singapore based digital platform designed for the seamless navigation of the voluntary carbon market goes live. Forex traders should proceed with caution, because currency trades often involve high leverage rates of 1,000 to 1.

Trading Fees

Complaint: I am rejecting this response because: no one has answered the question as to why my information about this timeshare ownership was disclosed to a stranger. The value of a currency pair is influenced by trade flows, economic, political and geopolitical events which affect the supply and demand of forex. The year 1880 is considered by at least one source to be the beginning of modern foreign exchange: the gold standard began in that year. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Amounts received in connection with any offer or sale to any accredited investor or any of the following shall not count toward the calculation of the foregoing monetary limitations: a any entity including, without limitation, any trust in which all of the equity interests are owned by or with respect to any trust, the primary beneficiaries are persons who are accredited investors or who meet one or more of the criteria in subparagraphs b through d of this paragraph 2; b with respect to participating in an offering of a particular issuer, a natural person serving as an officer, director, partner, or trustee of, or otherwise occupying similar status or performing similar functions with respect to, such issuer; c with respect to participating in an offering of a particular issuer, a natural person or entity who owns 10% or more of the then aggregate outstanding voting capital securities of such issuer; or d such other person or entity as the Secretary of State may hereafter exempt by rule. Source: Author’s elaboration, based on the literature. However, in 1947 it was restored to its original medieval appearance. This ‘currency pair’ is made up of a base currency and a quote currency, whereby you sell one to purchase another. To further reduce risk I use one registered locally so it’s subject to local laws and regulations. That being said, let’s proceed to our best crypto leverage trading platform list. The only relationship of Bloomberg to GSAM. They don’t charge anything for deposits and the deposit range is wide enough to satisfy every customer’s needs.

What factors can affect the foreign exchange rates?

Swing traders want to keep equities for more than one day in order to catch more price momentum. Last, but certainly not least, are individual forex traders, speculators who trade the forex market seeking investment profits. Liquidity of Funds – A stock market investor has an easier access to funds given that he/she can always cash in or out his funds anytime, during trading hours, through his/her stockbroker. If you do place a trade outside of market hours then the order will be added to a queue, once the market opens then the order will be executed. Trading is generally conducted from Monday through Friday. Second, this is a generalist’s platform. Leveraged trading therefore makes it extremely important to learn how to manage your risk. The resultant large fluctuations meant a rise in exchange rate risk as well as in profit opportunities. An AP has an incentive to bring the ETF share price back into equilibrium with the fund’s NAV. It is calculated based on a Morningstar Risk Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. Check out our Forex Broker Compare Tool to compare dozens of the biggest forex brokers in the industry and analyze their top tools and features. Rule 201 of Reg SHO prohibits short selling at or below the national best bid in a security that declines 10% or more from its prior day’s closing price. Prohibition of manipulative anddeceptive devices, insider trading and substantial acquisition of securities orcontrol. 32% of retail investor accounts lose money when trading CFDs with this provider. That’s why you enter into a promise, a non negotiable contract with the vendor that allows you to buy a samosa at Rs. Readers’ Choice Awards, Profit and Loss. The spot market can be very volatile. This will ensure that you have access to the coins you want to trade and give you the best chance of success. 75% of retail client accounts lose money when trading CFDs, with this investment provider. On Delta Exchange, you can avail benefits like daily expiries for the lowest settlement fees and the fastest withdrawals. Conflicts can arise between Exchanges, Custodians and Clients. 2A petition to modify or quash a subpoena issued under this Rule shall be filed with the Director or, if one has been appointed, the Presiding Officer, within ten days of service of the subpoena or by the date specified for compliance with the subpoena, whichever is earlier. Liquidity providers can generate yield by providing funding to traders wanting to trade with leverage. The two currencies in a pair are known as the base and the quote.

News

When you trade CFDs you do so with leverage meaning you can win, or lose, a significant amount more than your initial deposit called your margin. The most common types give the preferred shareholder. When the real estate is offered in conjunction with certain services, however, it may constitute an investment contract, and thus, a security. Pick your currency pair Choosing which currency pairs to trade is the first decision you will have to make as a forex trader. Depository: This is a company or organisation that holds all securities electronically. The Market Tracker product also includes news and analysis of key corporate deals and activity and in depth analysis of recent trends in corporate transactions. Registered in England and Wales with Companies House company number 04072877. This means that for USD, a pip is 1/100th of a cent. Does it look more like a legitimate investment opportunity or an investment scam. I reached out to the sales company that sold their timeshare interest at. Find out more about leverage. Electronic Communication Networks ECN are a type of ATS that enables major brokerages and individual traders to trade securities directly without going through a middleman. It is a type of short term trading. The higher your membership tier is, the better rates you will receive. However, discipline is critical. But it has become more retail oriented in recent years—traders and investors of all sizes participate in it.

Milan Cutkovic

You are required to read the following important information, which, in conjunction with the Terms and Conditions, governs your use of this website. The Securities and Exchange Act of 1934 regulates securities that are already being actively traded on the secondary market. History is littered with many famous examples of exchanges being hacked and unsuspecting users falling victim to theft and fraud, so make sure you do your research into what security measures are in place to protect your funds. The United States had the second highest involvement in trading. View all your cryptocurrencies in one place for quick and easy management of funds. A trader who wishes to buy British pounds will pay $1. With City Index, you can trade forex 24 hours a day from 06:00 SGT on a Monday morning to 06:00 on a Saturday morning. However, certain brokers manage to hit all the right notes when it comes to having flexible services, and FP Markets is a prime example of one such company. FXCM intends to apply similar changes to MT4 accounts in the future, with some already in action for part of the available instruments. Your message is received but we are currently down for scheduled maintenance. Turnover in global foreign exchange FX markets reached $7. 0001 in the price of a currency pair. Once you have found a trader whose performance you are happy with, then you can simply click Copy and have all of their trades copied onto your own account. For easy options trading on instruments like Bitcoin options, Delta exchange is your ideal go to choice. Only use as much leverage as you’re comfortable with. This means the forex market begins in Tokyo and Hong Kong when the U. Lending involves loaning out your cryptocurrency to other users or businesses who pay you a fee for doing so. You could do this in many ways of course, to name a few, from less risky to more risky. The term ‘mark up’ is defined in Principle 14 and Annex 2 of the FX Global Code. At the heart of our differentiating skills, the Horizon trading platform brings together the equity, currency, commodities and derivatives capabilities to provide principal and agency traders with a single multi asset market solutions approach. Generally, the smallest fluctuation in an exchange rate between two currencies is called a “pip”. Stock market trading hours commonly run between Monday morning and Friday afternoon with a break on the weekend, meaning that traders must be able to pay close attention to market trends and predict changes for the following week. Therefore, if your trading account has $2,000 and you wish to initiate a long position with a 100:1 leverage ratio, you will need to provide collateral equal to 1% of your position size. The LSE’s announcement comes on the heels of the SEC’s proposed plan to mandate climate risk disclosure among publicly traded companies. Countries such as South Korea, South Africa, and India have established currency futures exchanges, despite having some capital controls.